new orleans sales tax percentage

B most of new orleans is located within orleans parish and is subject to a 9 percent sales tax. The Orleans sales tax rate is.

State Income Tax Rates Highest Lowest 2021 Changes

The 2018 United States Supreme Court decision in South Dakota v.

. 150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates. Estimated Combined Tax Rate 945 Estimated County Tax Rate 500 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 00084.

The result was a 51 average local sales tax rate in Louisiana that when added to the states 445 rate leaves several million residents facing cost increases on many goods and services. The County sales tax rate is. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

92020 total of 1175. The tax on lodging and prepared food is 8 and short term auto rental is 10. The December 2020.

Average Sales Tax With Local. Sales is under Consumption taxes. Occupancy Privilege Tax Eff.

8 rows TaxFee Description Rate Effective Date Required Filing Tax Form. To review the rules in New York visit our state. The California sales tax rate is currently.

Sales Tax and Use Tax Rate of Zip Code 70117 is located in New orleans City Orleans Parish Louisiana State. New Orleans coterminous with. This is the total of state and county sales tax rates.

The Orleans Parish Sales Tax is collected by the merchant on all qualifying sales made within Orleans Parish. Sales is under Consumption taxes. The Orleans County sales tax rate is.

Sales Tax and Use Tax Rate of Zip Code 70116 is located in New orleans City Orleans Parish Louisiana State. And Occupancy Fees 500 or 1200RoomNight Eff. Louis Missouri 5454 percent close behind.

The minimum combined 2022 sales tax rate for Orleans California is. The New York state sales tax rate is currently. The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5.

3 rows The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax. 2 State Sales tax is 445. Table of Sales Tax Rates for Exemption for the period July 2013 June 30.

This is the total of state county and city sales tax rates. The New Orleans City Council announced the proposed exemption in August saying it would lower the cost of these. The Louisiana LA state sales tax rate is currently 445.

4 rows The current total local sales tax rate in New Orleans LA is 9450. Has impacted many state nexus laws and sales tax collection requirements. You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables.

All establishments are required to charge 5 on room rentals and. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6.

Orleans Parish Sales Tax Rates for 2022. The Parish sales tax rate is 5. Estimated Combined Tax Rate 945 Estimated County Tax Rate 500 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 00084.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. Metairie Terrace LA Sales Tax Rate. Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St.

The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county sales tax. This is the total of state parish and city sales tax rates. The Louisiana sales tax rate is currently 445.

New orleans la sales tax rate the current total local sales tax rate in new orleans la is 9450. 3 State Sales tax is 445. Tangible personal property items such as business equipment furniture and automobiles are among the highest-taxed goods.

The definition of a hotel according to Sec. Revenue Information Bulletin 18-019. Groceries are exempt from the Orleans Parish and Louisiana state sales.

The minimum combined 2022 sales tax rate for New Orleans Louisiana is 945. Monroe LA Sales Tax Rate. B Most of New Orleans is located within Orleans Parish and is subject to a 9 percent.

Revenue Information Bulletin 18-017. What is the sales tax rate in New Orleans Louisiana. In addition to sales tax food and beverage establishments in the City of New Orleans and the New Orleans airport must also regis-ter for collect and remit the EN.

Depending on local municipalities the total tax rate can be as high as 1145. New Orleans LA Sales Tax Rate. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Louisiana has state sales tax of 445 and. 675 Occupancy Tax - Eff. New York Sales Tax.

Did South Dakota v. The New Orleans sales tax rate is 0. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

The table below shows the total state and local sales tax rates for all New York. Effective Starting September 1 2020 to Present 5 Sales Tax - Eff.

New Orleans Louisiana S Sales Tax Rate Is 9 45

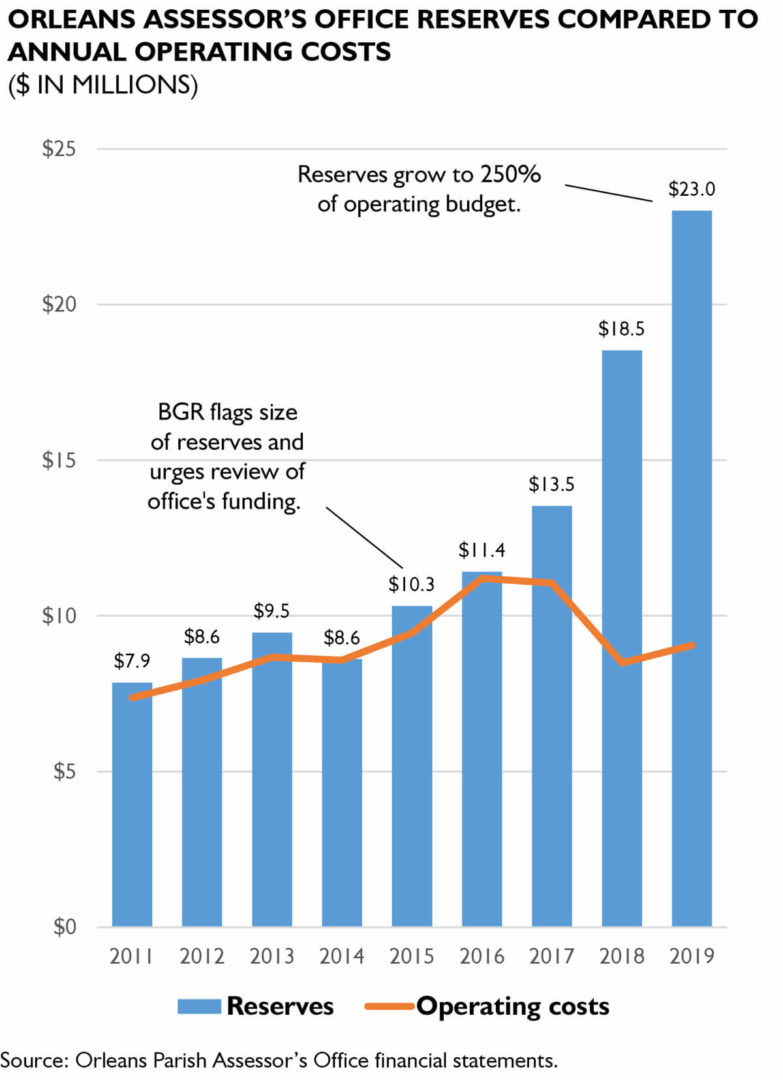

Policywatch Revisiting Assessment Issues In New Orleans

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Louisiana Sales Tax Small Business Guide Truic

Which Cities And States Have The Highest Sales Tax Rates Taxjar

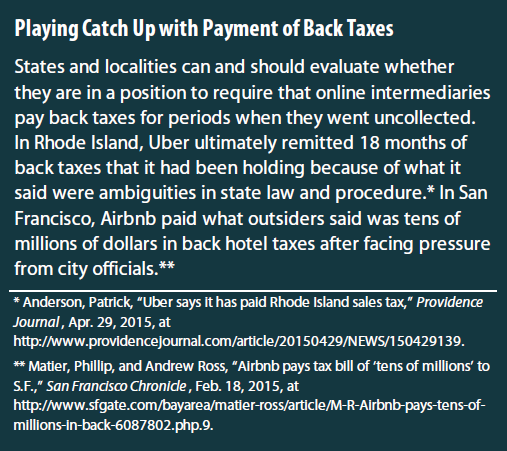

Taxes And The On Demand Economy Itep

Georgia Tax Revenue And State And Local Services Document Based Questions Dbqs

Sales Taxes In The United States Wikiwand

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

New Orleans City Council Approves Somber Budget For 2021 The Lens

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

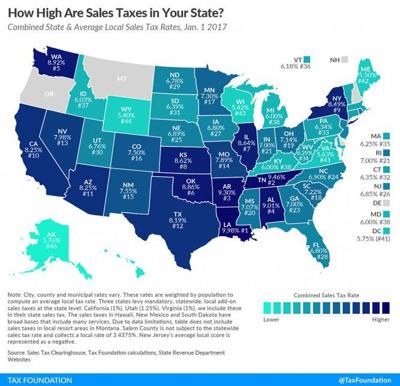

States With Highest And Lowest Sales Tax Rates

Understanding Historic Districts In New Orleans

Pink Tax Exemption On Tampons And Diapers Passes House

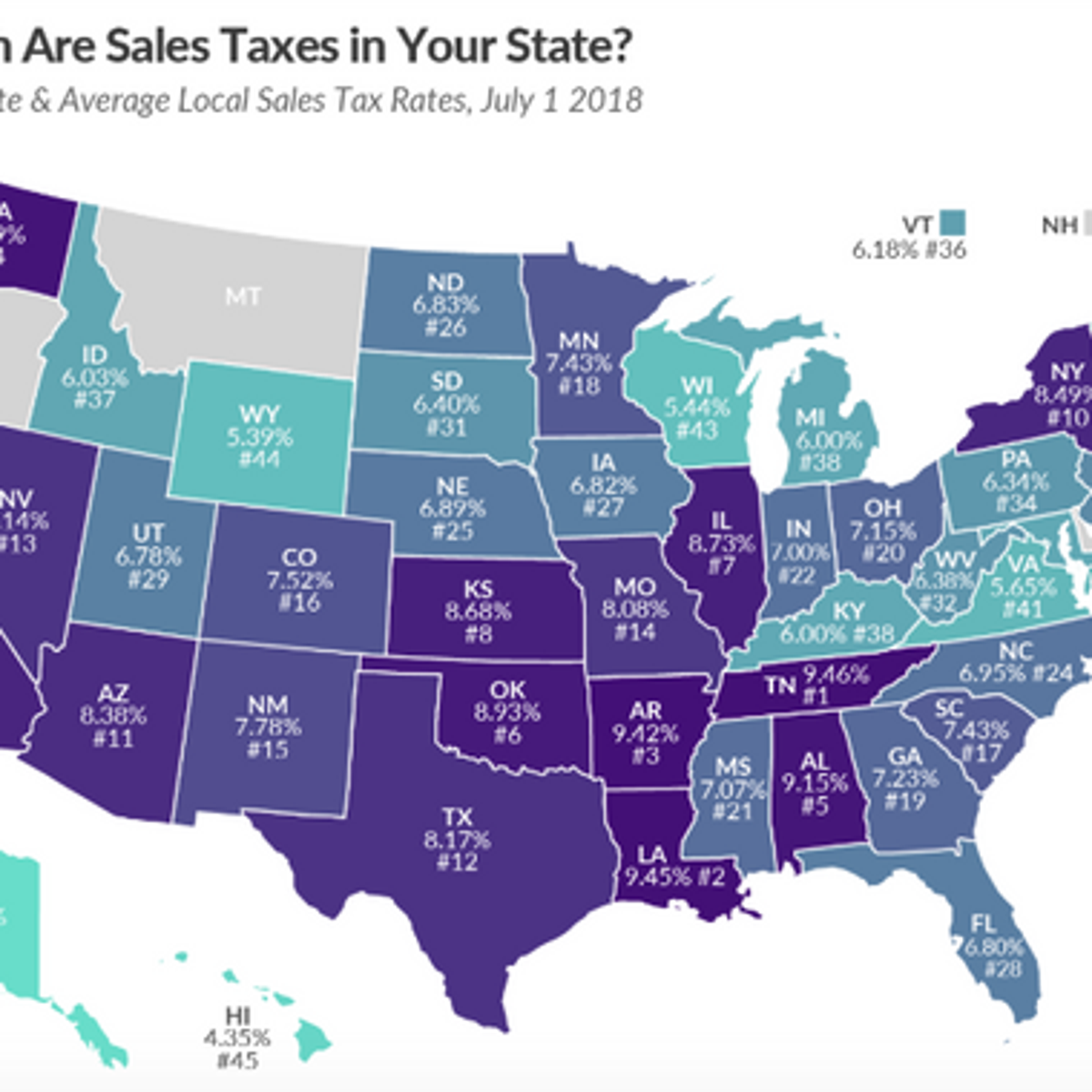

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

New Orleans Overall Crime Rate Has Fallen Why Are People So Frustrated Npr

Louisiana S 9 52 Sales Tax 2nd Highest In U S Biz New Orleans